Over 65

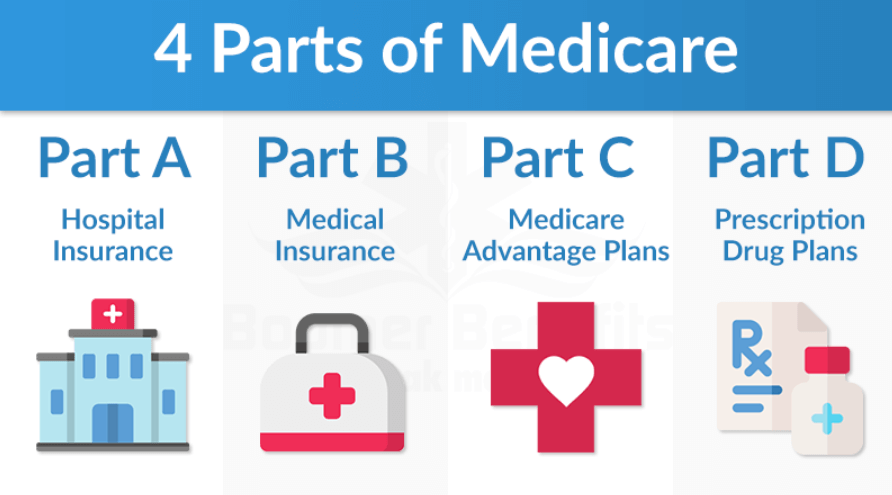

Work with the experts at MedMyWay to figure out what coverage options will work best for you. Medicare can be confusing with Part A, Part B, Part C, Part D, Medicare Advantage Plans, and Medicare Supplements. Let us help you figure out what is best for you!

2025 Medicare Annual Enrollment is October 15th thru December 7th

New to Medicare?

Are you turning 65 this year? You have a lot of choices when it comes to Medicare!

Is the amount of Medicare Mail you are receiving making your head spin? Contact your agent to help guide you through decisions about the kind of coverage you need. You may want to discuss:

- Enrollment in Part A, Part B or both.

- Make other coverage choices such Medicare supplements, Part D and Advantage plans, if you enroll in both Parts A and B.

It’s the A, B, C and D’s of Medicare! Ask your agent to go over your options!

You must notify Medicare if you were enrolled in Part B automatically and choose to delay or refuse it. Follow the directions on the back of your Medicare card. Be advised that you could be charged a Part B premium penalty if you decide to enroll in Part B later, unless you qualify for a special enrollment period.

Thousands of Baby Boomers are turning 65 every day! Is it your turn? Here’s what you need to know:

You must be 65 to enroll in Medicare—your spouse’s age doesn’t count.

You may enroll in Medicare even if you work past age 65 and have employer coverage, or you are 65 and have coverage through your spouse’s employer.

You may enroll in Medicare even if you’re not collecting Social Security yet.

Medicare Supplement Insurance

Medicare supplement insurance (Medigap) helps pay some of the out-of-pocket health care costs that Original Medicare (Parts A and B) doesn’t pay. It isn’t a government benefit, like Parts A and B. Plans are offered through private insurance companies. It’s your decision whether to buy a plan or not.

There are 10 standardized Medicare supplement insurance plans, labeled “A” through “N.” (These letters are not related to the Medicare Part A, B, C and D labels.) The plans and what they cover are prescribed by the federal government.

Medicare Supplement Insurance

Medicare supplement insurance (Medigap) helps pay some of the out-of-pocket health care costs that Original Medicare (Parts A and B) doesn’t pay. It isn’t a government benefit, like Parts A and B. Plans are offered through private insurance companies. It’s your decision whether to buy a plan or not.

There are 10 standardized Medicare supplement insurance plans, labeled “A” through “N.” (These letters are not related to the Medicare Part A, B, C and D labels.) The plans and what they cover are prescribed by the federal government.

Your first chance to sign up for Medicare is called your Initial Enrollment Period (IEP). It happens around your 65th birthday and lasts a total of 7 months. It includes your birthday month plus the 3 months before and the 3 months after. It’s best to sign up early to avoid gaps in coverage and late enrollment penalties.

You may be enrolled in Medicare automatically if you currently receive Social Security or Railroad Retirement Board benefits. You’ll receive your Medicare card in the mail a few months before your 65th birthday. You still have an Initial Enrollment period during which you may make Medicare coverage decisions.

Your first chance to sign up for Medicare is called your Initial Enrollment Period (IEP). It happens around your 65th birthday and lasts a total of 7 months. It includes your birthday month plus the 3 months before and the 3 months after. It’s best to sign up early to avoid gaps in coverage and late enrollment penalties.

You may be enrolled in Medicare automatically if you currently receive Social Security or Railroad Retirement Board benefits. You’ll receive your Medicare card in the mail a few months before your 65th birthday. You still have an Initial Enrollment period during which you may make Medicare coverage decisions.

What Does Medicare Supplement Insurance Cover?

The main purpose of a Medicare supplement plan is to cover some of the out of pocket costs that are not paid by Medicare Parts A and B, like deductibles, co-pays and co-insurance.

Each of the standardized plans provides benefits for different out-of-pocket costs.

Each standardized plan with the same letter must offer the same basic benefits, no matter which insurance company sells it. For example the basic benefits of one company’s Plan F are the same as the basic benefits of another company’s Plan F. The only difference between Medicare supplement plans with the same letter sold by different insurance companies is typically cost.

Action- Contact your agent to help you with comparisons of your Medicare Supplement options and costs as these can vary year to year.

What Does Medicare Supplement Insurance Cover?

The main purpose of a Medicare supplement plan is to cover some of the out of pocket costs that are not paid by Medicare Parts A and B, like deductibles, co-pays and co-insurance.

Each of the standardized plans provides benefits for different out-of-pocket costs.

Each standardized plan with the same letter must offer the same basic benefits, no matter which insurance company sells it. For example the basic benefits of one company’s Plan F are the same as the basic benefits of another company’s Plan F. The only difference between Medicare supplement plans with the same letter sold by different insurance companies is typically cost.

Action- Contact your agent to help you with comparisons of your Medicare Supplement options and costs as these can vary year to year.

READY TO GET STARTED?

Contact your Jeff or Suzanne at MedMyWay. We will work together to make sure you’re covered.