Category: blog

Categories

2025 Medicare Update

- Post author By Jeff Janosick

- Post date May 15, 2024

- No Comments on 2025 Medicare Update

2025 Medicare Update

Do you want to know more?

Categories

2025 Medicare Annual Enrollment Period – Start Here

- Post author By Jeff Janosick

- Post date September 28, 2022

- No Comments on 2025 Medicare Annual Enrollment Period – Start Here

Medicare Annual Enrollment Period 2025 - Start Here

Ready for 2025 Medicare Annual Enrollment Period?

Check out this video message to learn more.

More information about Annual Notice of Change

By the end of September, you should have received the Annual Notice of Change (ANOC) for your current Medicare Advantage Prescription Drug Plan (MAPD) or Medicare Stand-alone Prescription Drug Plan (PDP). Please review the Annual Notice of Change (ANOC) document.

Some plans may adjust their premiums or copays, make modifications to the prescriptions included on their drug formulary list, or make benefit changes.

If you have any questions or would like to review your options, please do not hesitate to contact your agent, Jeff or Suzanne. We are contracted with most insurance companies. We work for you, not the insurance company!

The 2025 Medicare Annual Enrollment Period runs from October 15 through December 7.

If you are satisfied with the plan design for 2025, there is nothing additional for you to do. Your new card and information for next year will automatically be sent to you by the end of 2024.

Call us with any questions or schedule a time to talk with Jeff or Suzanne using the buttons above.

Do you want to know more?

2025 Medicare Part D - Stand-alone Prescription Drug Plans (PDP)

Ready for 2025 Medicare Annual Enrollment Period?

Check out this video message to learn more.

Please review your Annual Notice of Change for your Stand-alone Prescription Drug Plan (PDP)

By the end of September, you should have received the Annual Notice of Change (ANOC) for your Medicare Stand-alone Prescription Drug Plan (PDP).

Some plans may adjust their premiums or copays, make modifications to the prescriptions included on their drug formulary list, or make benefit changes.

If you have any questions or would like to review your options, please do not hesitate to contact your agent, Jeff or Suzanne. We are contracted with most insurance companies. We work for you, not the insurance company!

The 2025 Medicare Annual Enrollment Period runs from October 15 through December 7.

If you are satisfied with the plan design of your Stand-alone Prescription Drug Plan (PDP) for 2025, there is nothing additional for you to do. Your new card and information for 2025 will automatically be sent to you by the end of 2024.

Call us with any questions or schedule a time to talk with Jeff or Suzanne using the buttons above.

Do you want to know more?

How to pick a Medicare Part D - Stand-alone Prescription Drug Plan

Do you have the right Part D RX drug plan?

Use our finder to select the best plan for you!

Use our website to make sure you have the best drug plan for your unique situation during Annual Enrollment Period (October 15 – December 7). Enter your drugs with dosages and your preferred pharmacy to see which plan will work for you next year.

Important Points:

1. We do NOT represent ALL of the drug plans. Some Part D insurance companies do not work with agents so we cannot show their plans on our website.

2. You must CLICK the Prescription Drugs tab to search Part D plans. The page default takes you to to Medicare Advantage on the quoting site.

3. The default start date is January 1 if you are signing up during the AEP period (October 15 – December 7). After this period, the default effective date is the 1st of the next month.

4. If you are currently on a Medicare Advantage plan, and sign up for a Part D plan, this will disenroll you from that Medicare Advantage plan. Make sure you first have been approved for a Medicare Supplement, if you are applying for one.

5. If you make an account on the page, DO NOT use the +4 ZIP code. Just use the 5 digit ZIP code.

If you have any questions or would like to review your options, please do not hesitate to contact your agent, Jeff or Suzanne. We are contracted with most insurance companies. We work for you, not the insurance company!

Do you want to know more?

2024 Medicare Parts A & B Premiums and Deductibles

Oct 12, 2023

On October 12, 2023, the Centers for Medicare & Medicaid Services (CMS) released the 2024 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs, and the 2024 Medicare Part D income-related monthly adjustment amounts.

The Medicare Savings Programs (MSPs) help more than 10 million people with coverage of Medicare premiums and, in most cases, other cost sharing. In their continued efforts to improve access to health care and lower costs for millions of Americans, the Department of Health and Human Services (HHS), through CMS, recently finalized a rule to streamline enrollment in MSPs, making coverage more affordable for an estimated 860,000 people. In addition, the Part D low‑income subsidy (LIS) helps pay for the Part D premium and lowers the cost of prescription drugs. Further, the Inflation Reduction Act recently expanded the number of people eligible for full LIS.

Medicare Part B Premium and Deductible

Medicare Part B covers physicians’ services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A.

Each year, the Medicare Part B premium, deductible, and coinsurance rates are determined according to provisions of the Social Security Act. The standard monthly premium for Medicare Part B enrollees will be $174.70 for 2024, an increase of $9.80 from $164.90 in 2023. The annual deductible for all Medicare Part B beneficiaries will be $240 in 2024, an increase of $14 from the annual deductible of $226 in 2023.

The increase in the 2024 Part B standard premium and deductible is mainly due to projected increases in health care spending and, to a lesser degree, the remedy for the 340B-acquired drug payment policy for the 2018-2022 period under the Hospital Outpatient Prospective Payment System.

Beginning in 2023, individuals whose full Medicare coverage ended 36 months after a kidney transplant and who do not have certain other types of insurance coverage can elect to continue Part B coverage of immunosuppressive drugs by paying a premium. For 2024, the standard immunosuppressive drug premium is $103.00.

Medicare Part B Income-Related Monthly Adjustment Amounts

Since 2007, a beneficiary’s Part B monthly premium has been based on his or her income. These income-related monthly adjustment amounts affect roughly 8 percent of people with Medicare Part B. The 2024 Part B total premiums for high-income beneficiaries with full Part B coverage are shown in the following table:

Full Part B Coverage | |||

Beneficiaries who file individual tax returns with modified adjusted gross income: | Beneficiaries who file joint tax returns with modified adjusted gross income: | Income-Related Monthly Adjustment Amount | Total Monthly Premium Amount |

Less than or equal to $103,000 | Less than or equal to $206,000 | $0.00 | $174.70 |

Greater than $103,000 and less than or equal to $129,000 | Greater than $206,000 and less than or equal to $258,000 | $69.90 | $244.60 |

Greater than $129,000 and less than or equal to $161,000 | Greater than $258,000 and less than or equal to $322,000 | $174.70 | $349.40 |

Greater than $161,000 and less than or equal to $193,000 | Greater than $322,000 and less than or equal to $386,000 | $279.50 | $454.20 |

Greater than $193,000 and less than $500,000 | Greater than $386,000 and less than $750,000 | $384.30 | $559.00 |

Greater than or equal to $500,000 | Greater than or equal to $750,000 | $419.30 | $594.00 |

The 2024 Part B total premiums for high-income beneficiaries who only have immunosuppressive drug coverage are shown in the following table:

Part B Immunosuppressive Drug Coverage Only | |||

Beneficiaries who file individual tax returns with modified adjusted gross income: | Beneficiaries who file joint tax returns with modified adjusted gross income: | Income-Related Monthly Adjustment Amount | Total Monthly Premium Amount |

Less than or equal to $103,000 | Less than or equal to $206,000 | $0.00 | $103.00 |

Greater than $103,000 and less than or equal to $129,000 | Greater than $206,000 and less than or equal to $258,000 | $68.70 | $171.70 |

Greater than $129,000 and less than or equal to $161,000 | Greater than $258,000 and less than or equal to $322,000 | $171.70 | $274.70 |

Greater than $161,000 and less than or equal to $193,000 | Greater than $322,000 and less than or equal to $386,000 | $274.70 | $377.70 |

Greater than $193,000 and less than $500,000 | Greater than $386,000 and less than $750,000 | $377.70 | $480.70 |

Greater than or equal to $500,000 | Greater than or equal to $750,000 | $412.10 | $515.10 |

Premiums for high-income beneficiaries with full Part B coverage who are married and lived with their spouse at any time during the taxable year but file a separate return, are as follows:

Full Part B Coverage | ||

Beneficiaries who are married and lived with their spouses at any time during the year, but who file separate tax returns from their spouses with modified adjusted gross income: | Income-Related Monthly Adjustment Amount | Total Monthly Premium Amount |

Less than or equal to $103,000 | $0.00 | $174.70 |

Greater than $103,000 and less than $397,000 | $384.30 | $559.00 |

Greater than or equal to $397,000 | $419.30 | $594.00 |

Premiums for high-income beneficiaries with immunosuppressive drug only Part B coverage who are married and lived with their spouse at any time during the taxable year but file a separate return, are as follows:

Part B Immunosuppressive Drug Coverage Only | ||

Beneficiaries who are married and lived with their spouses at any time during the year, but who file separate tax returns from their spouses with modified adjusted gross income: | Income-Related Monthly Adjustment Amount | Total Monthly Premium Amount |

Less than or equal to $103,000 | $0.00 | $103.00 |

Greater than $103,000 and less than $397,000 | $377.70 | $480.70 |

Greater than or equal to $397,000 | $412.10 | $515.10 |

Medicare Part A Premium and Deductible

Medicare Part A covers inpatient hospitals, skilled nursing facilities, hospice, inpatient rehabilitation, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment, as determined by the Social Security Administration.

The Medicare Part A inpatient hospital deductible that beneficiaries pay if admitted to the hospital will be $1,632 in 2024, an increase of $32 from $1,600 in 2023. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period. In 2024, beneficiaries must pay a coinsurance amount of $408 per day for the 61st through 90th day of a hospitalization ($400 in 2023) in a benefit period and $816 per day for lifetime reserve days ($800 in 2023). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in a benefit period will be $204.00 in 2024 ($200.00 in 2023).

Part A Deductible and Coinsurance Amounts for Calendar Years 2023 and 2024 | ||

| 2023 | 2024 |

Inpatient hospital deductible | $1,600 | $1,632 |

Daily hospital coinsurance for 61st-90th day | $400 | $408 |

Daily hospital coinsurance for lifetime reserve days | $800 | $816 |

Skilled nursing facility daily coinsurance (days 21-100) | $200.00 | $204.00 |

Enrollees age 65 and older who have fewer than 40 quarters of coverage and certain persons with disabilities pay a monthly premium in order to voluntarily enroll in Medicare Part A. Individuals who had at least 30 quarters of coverage or were married to someone with at least 30 quarters of coverage may buy into Part A at a reduced monthly premium rate, which will be $278 in 2024, the same amount as 2023. Certain uninsured aged individuals who have less than 30 quarters of coverage and certain individuals with disabilities who have exhausted other entitlement will pay the full premium, which will be $505 a month in 2024, a $1 decrease from 2023.

For more information on the 2024 Medicare Parts A and B premiums and deductibles (CMS-8083-N, CMS-8084-N, CMS-8085-N), please visit https://www.federalregister.gov/public-inspection.

Medicare Part D Income-Related Monthly Adjustment Amounts

Since 2011, a beneficiary’s Part D monthly premium has been based on his or her income. These income-related monthly adjustment amounts affect roughly 8 percent of people with Medicare Part D. These individuals will pay the income-related monthly adjustment amount in addition to their Part D premium. Part D premiums vary plan and regardless of how a beneficiary pays their Part D premium, the Part D income-related monthly adjustment amounts are deducted from Social Security benefit checks or paid directly to Medicare. Roughly two-thirds of beneficiaries pay premiums directly to the plan while the remainder have their premiums deducted from their Social Security benefit checks. The 2024 Part D income-related monthly adjustment amounts for high-income beneficiaries are shown in the following table:

Beneficiaries who file individual tax returns with modified adjusted gross income: | Beneficiaries who file joint tax returns with modified adjusted gross income: | Income-related monthly adjustment amount |

Less than or equal to $103,000 | Less than or equal to $206,000 | $0.00 |

Greater than $103,000 and less than or equal to $129,000 | Greater than $206,000 and less than or equal to $258,000 | $12.90 |

Greater than $129,000 and less than or equal to $161,000 | Greater than $258,000 and less than or equal to $322,000 | $33.30 |

Greater than $161,000 and less than or equal to $193,000 | Greater than $322,000 and less than or equal to $386,000 | $53.80 |

Greater than $193,000 and less than $500,000 | Greater than $386,000 and less than $750,000 | $74.20 |

Greater than or equal to $500,000 | Greater than or equal to $750,000 | $81.00 |

Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year but file a separate return, are as follows:

Beneficiaries who are married and lived with their spouses at any time during the year, but file separate tax returns from their spouses with modified adjusted gross income: | Income-related monthly adjustment amount |

Less than or equal to $103,000 | $0.00 |

Greater than $103,000 and less than $397,000 | $74.20 |

Greater than or equal to $397,000 | $81.00 |

Categories

Kentucky’s Health Insurance Marketplace

- Post author By Jeff Janosick

- Post date September 12, 2022

- No Comments on Kentucky’s Health Insurance Marketplace

Kentucky’s Health Insurance Marketplace

Kentucky moved from healthcare.gov to Kynect for 2022 and beyond. The transition was a little bumpy for many Kentucky residents. If you need help with under age 65 health insurance in Kentucky and you are already in the Kynect system, I can try to help. First, you must assign me as your agent by calling Kynect at 1-855-306-8959 or logging into your Kynect profile. Please make sure you assign me as your Insurance Agent (not authorized rep), Jeffrey Janosick MedMyWay NPN 10935898. Once I am assigned as your agent, I can access your information on Kynect and try to help sort out any issues you are having or help find new coverage. Due to complexities with Kynect, I cannot guarantee I can solve all problems but I can try to help.

All these Medicare commercials, what are they talking about?

Check out this video message to learn more.

Medicare Savings Programs

You can get help from your state paying your Medicare premiums. In some cases, Medicare Savings Programs may also pay Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance) deductibles, coinsurance, and copayments if you meet certain conditions.

How do I apply for Medicare Savings Programs?

- Do you have, or are you eligible for, Part A?

- Is your income at, or below, the income limits listed for any of the programs at the links below?

- Do you have limited resources, below the limits listed at the links below?

Do you want to know more?

Categories

New to Medicare? Start Here

- Post author By Jeff Janosick

- Post date May 2, 2022

- No Comments on New to Medicare? Start Here

- Sticky post

New to Medicare? Start Here!

There are so many Medicare options. Which one is right for you?

Let us help at MedMyWay. Schedule a time with us to discuss your options.

Do you want to know more?

Categories

What are the Parts of Medicare?

- Post author By Jeff Janosick

- Post date April 29, 2022

- No Comments on What are the Parts of Medicare?

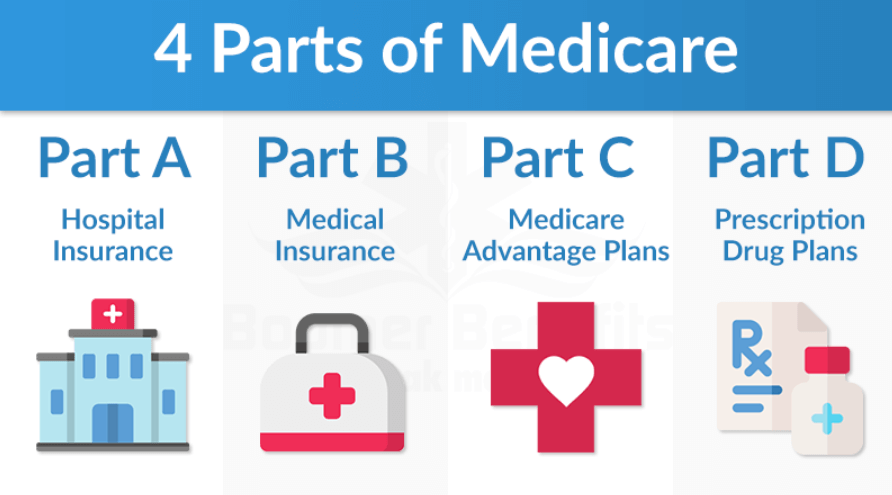

The Four Parts of Medicare

Check out the video above to learn about parts of Medicare.

Summary of the Parts of Medicare ...

Part A. Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called “premium-free Part A.” Most people get premium-free Part A.

Part B. Medicare Part B helps cover medical services like doctors’ services, outpatient care, and other medical services that Part A doesn’t cover. Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary. Most people have to pay a premium to get Part B from Medicare.

Part C. A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by Medicare-approved private companies that must follow rules set by Medicare. If you join a Medicare Advantage Plan, you’ll still have Medicare but you’ll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare.

Part D. Medicare Part D is a voluntary outpatient prescription drug benefit for people with Medicare, provided through private plans approved by the federal government. Beneficiaries can choose to enroll in either a stand-alone prescription drug plan (PDP) to supplement traditional Medicare or a Medicare Advantage prescription drug plan (MA-PD), mainly HMOs and PPOs, that cover all Medicare benefits including drugs.